Example Business Case. MBuddy: Your Path to Financial Literacy Starts Here.

Diana Tuman, PhD, MS, GC

Welcome back, curious minds; I’m so happy you’re embarking on this journey. From the first post that likely left you hungry and searching for the nearest pizza, we discussed compelling business cases and ways to tailor the approach. Today, with our client’s consent, we will demonstrate a version of a business using a real-world example: MBuddy, an app set to change how we teach children about money. Financial literacy isn’t just about dollars and cents; it’s about shaping a brighter future, one savvy decision at a time. The secret sauce turns lemonade stand earnings into college funds, allowances into investments, and budgeting into stress-free family vacations.

But hold on, before we embark on this thrilling journey, let’s take a moment to reflect on a timeless truth – where there’s money, there’s the potential for things to go awry. Countless businesses, big and small, have navigated treacherous financial waters without the compass of a well-structured business case. Drawing insights from theories, real-world business experiences, and the vast library of literature on best practices for business cases, we’re about to embark on a financial journey like no other. So, fasten your seatbelts, grab your pocket calculators, and get ready to be the next Warren Buffett (minus the Oracle of Omaha’s folksy charm).

Lesson One: Know your Audience.

- Intimately understand your target audience, their pain points, preferences.

- Know what drives customer decisions and how the product will make them feel.

- Anticipate the emotion your product will evoke.

- Anticipate why they will switch and continue to use your service.

- Position the company and your product from the perspective of that target audience, recognizing the need for innovation and adaptation from the start, anticipating that the solution will evolve to match the changing landscape.

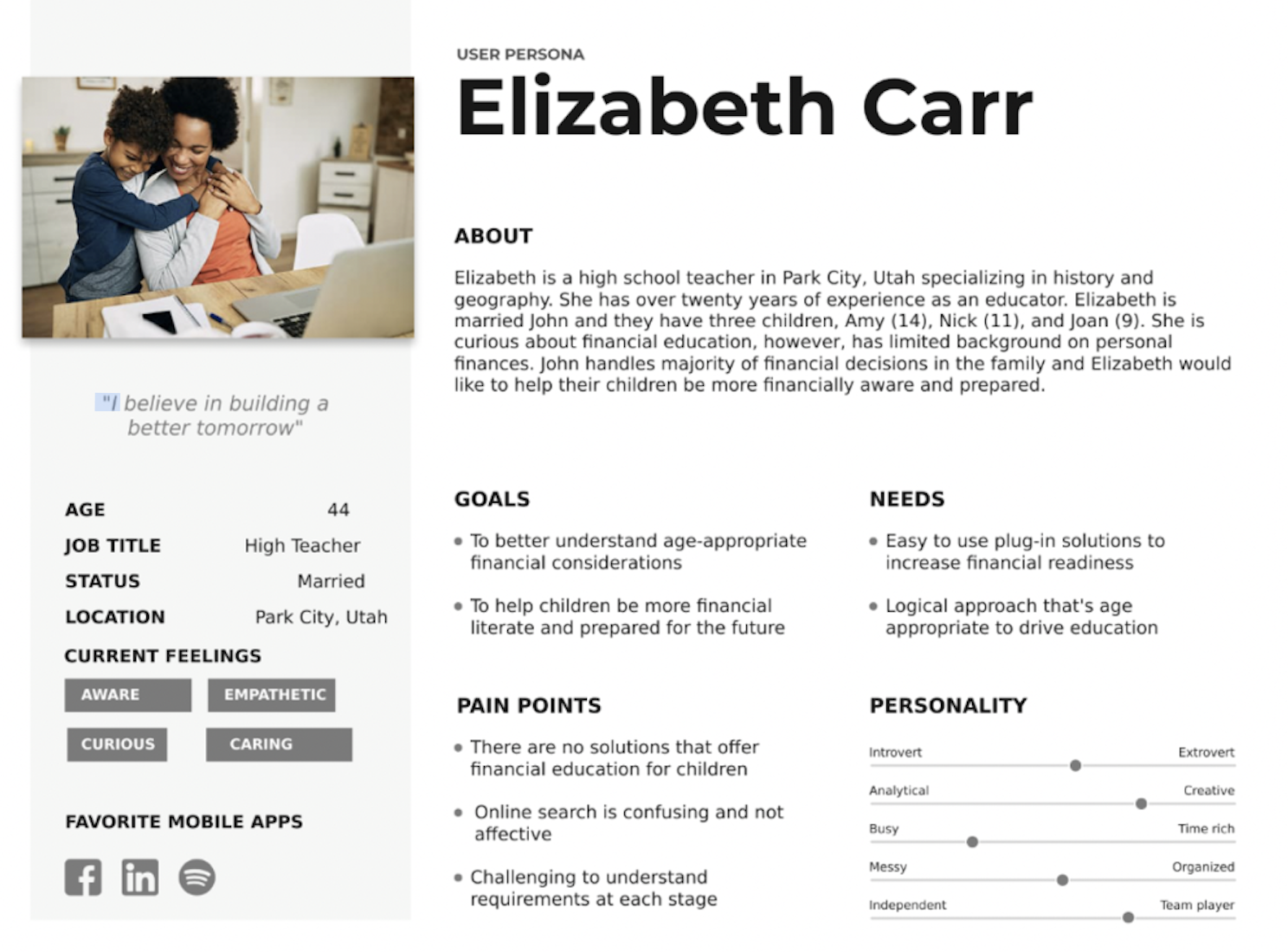

As such, we began with in-depth research to define the target persona by constructing a series of in-depth cards with our client. User personas help you understand the needs, barriers, and goals leading to tailored development, marketing, and long-term product strategy. This customer-centric approach similarly helps to assess the total addressable market, analyze the competition, and construct segmentation strategies. Companies that take advantage of this critical step may design a product for which there is no interest or need, leading to low adoption rates, negative reviews, and resource wastage.

Recall when Netflix approached Blockbuster with an offer to partner in online DVD rental in the early 2000s, which Blockbuster promptly refused, claiming that their customers prefer the physical experience. Their business case failed to meet the evolving customer mindset amid a digital revolution. Without understanding the essential customer needs and changing competitive landscape that effectively addressed the increased desire for convenience and accessibility that Netflix offered, Blockbuster, as you know, ceased to exist.

Lesson Two: Be a Storyteller.

- Emphasize the human aspect of the product.

- Ensure the business resonates emotionally.

When an investor hears 15 presentations daily, a powerful story is memorable and creates a personal connection between you, the company, and investors, creating trust and shared purpose. One company that demonstrated the power of storytelling in attracting investment is Airbnb. In its early days, Airbnb faced skepticism from potential investors and the challenge of convincing people to open their homes to strangers. The founders, Brian Chesky, Joe Gebbia, and Nathan Blecharczyk, created a narrative around “belonging anywhere.” They shared personal stories of their travels and their connections with locals, highlighting the hosts and guests who became friends. This approach helped Airbnb secure early funding and grow into the global hospitality giant it is today.

Lesson Three: Let the Data Speak.

While clear user personas define your strategy and compelling storytelling captures the audience, numbers remain the heartbeat of your business case. The simple truth in business is that numbers don’t lie. Data offers trends and paints a clear picture for investors to make informed decisions about your business proposal. But they’re not just cold, hard data points. They tell a story of growth, potential, and profitability. When presenting data, explain how each dollar invested will multiply and yield returns. Investors need to see not just what they’re spending but what they’re gaining when working with your business. When possible, include the following:

- Snapshot of the company’s financial health and revenue.

- Overview of expenses, profit margins, and liquidity.

- Quantify risk and devise mitigation strategies.

- Note market volatility and supply chain disruptions and offer data-driven risk management for long-term sustainability.

- Quantify customer acquisition costs, sales conversion rates, or employee productivity.

- Consider resource allocation and budget asks based on current or historical data to project business returns.

Calculating ROI is one of the most critical uses of numbers in a business case. This figure quantifies the benefits of an investment compared to its costs. It ultimately validates whether a project or initiative is worth pursuing. Accurate ROI calculations are essential for securing funding and aligning stakeholders. Recall a Silicon Valley startup – Juicero, and its brief stint on the market in 2017. They raised $120M for a $400 Wi-Fi-enabled cold-press juicer that used pre-packaged juice packs, which customers quickly realized they could squeeze on their own, making the technology entirely irrelevant. The ROI for this product did not justify the investment, and the product soon became redundant.

While numbers can be somewhat of a sensitive subject, I’ll keep the example of MBuddy high-level to demonstrate the business case approach. Naturally, we started with calculating the market size, which is this case were students kindergarten through 12th grade:

- 50M k – 12 grade students in the US. Assuming 10% are interested in advancing their financial literacy, 5M represents the total addressable market (TAM).

- Following we can anticipate targeting 10% of the TAM thus suggesting that 500,000 students are the estimated target US market.

Similarly, we addressed the revenue streams totaling $1.5M in year one in the following way:

- Subscription revenue model: Assume an average monthly subscription fee of $10 per user, with a goal of reaching 10,000 users in the first year. This would result in $1.2 million in subscription revenue per year.

- In-app purchases: Assume an average in-app purchase of $5 per user per year, with an estimated 30% of users making at least one purchase. This would result in $150,000 in in-app purchase revenue per year.

- Advertising revenue: Assume an estimated $0.25 per user per month in advertising revenue, with a goal of reaching 100,000 monthly viewers in the first year. This would result in $300,000 in advertising revenue per year.

Cost structures were also addressed, with an anticipated total of $900,000 in year one:

- Development costs: Assume a development cost of $300,000 for the first year.

- Hosting and server costs: Assume an estimated hosting and server cost of $100,000 for the first year.

- Marketing and advertising costs: Assume a marketing and advertising budget of $500,000 for the first year.

Key financial metrics for MBuddy were as follows:

- Gross profit margin: Gross profit margin is the percentage of revenue that remains after deducting the cost of goods sold. Assuming a gross profit margin of 70%, the gross profit for year one would be $1.155 million.

- Customer Acquisition Cost (CAC): Assume a CAC of $30 per user, with a goal of reaching 10,000 users in the first year. This would result in a total CAC of $300,000 for year one.

- Lifetime Value of a Customer (LTV): Assume an LTV of $120 per user, calculated as the average monthly subscription fee multiplied by the estimated lifetime of a customer (3 years). This would result in a total LTV of $3.6 million for year one.

- Break-even analysis: Based on the assumptions above, the app would break even after acquiring approximately 7,500 users in the first year.

Lesson Four: Start Selling Before You Have a Product.

A mentor once emphasized that anytime one starts a business to be successful, one’s mindset must shift from execution to that of an entrepreneur and a salesperson. As much as you may love logistics and operations, commercialization and marketing are pivotal to longevity and growth. Investors are no different and often want to know in explicit detail how you will close the gap on the money they invest in your business, how you’ll drive profit, and timelines for execution. Investors are no different and often want to know in explicit detail how you will close the gap on the money they invest in your business, how you’ll drive profit, and when. In the previous lesson, you convinced investors that the market is viable by answering the fundamental question: Is there a market for this product?

A robust commercialization and marketing strategy shows that you understand the need and have an effective plan for strategically reaching the customers. Carry your storytelling skills forward, and include the competitor assessment, product differentiation features that set you apart from the competition, and marketing strategies that build on those nuances. Highlighting your ability to position the product uniquely, identify niche markets, and leverage marketing channels can be a crucial differentiator. It shows that you’re not just introducing a product but in a way that stands out. Marketing is not just about selling; it’s about creating and nurturing customer relationships. Demonstrating your prowess in this area implies that you have a customer-centric approach. A solid marketing plan considers potential challenges and ways to mitigate them. Investors are often risk-averse and want assurance that you’ve thought through potential hurdles and have a plan to address them. Commercialization and marketing strategies should outline how the product can scale and grow in the market. Investors look for opportunities for expansion and increased market share. Your ability to convey a clear growth trajectory is compelling. Successful marketing and commercialization strategies are based on real-world market research and testing. Incorporating data and examples of how your designs have succeeded in similar contexts adds credibility to your business case.

Numerous case studies illustrate the importance of a clear marketing and commercialization strategy. Segway is one case where poor customer definition, segmentation, and ill-fitting marketing strategy resulted in numerous challenges in finding a niche in the transportation market, given the cost. Google Glass is another product where marketing and commercialization strategies did not communicate practical applications, resulting in limited adoption and discontinuation.

With MBuddy we started with a SWOT analysis, defined proposed marketing strategies and clearly articulated sales channels to demonstrate a well-throughout business plan.

SWOT Analysis:

Strengths:

- Unique value proposition: app driving financial literacy for children offers a unique and necessary value that promotes critical skills children need for the future. .

- Large and growing market: growing market due to the increasing awareness of the importance of financial literacy.

- Positive social impact: positive impact on society by improving financial habits and reducing financial stress in families.

- Convenience and accessibility: accessible way for children to learn about financial literacy at their own pace and in their own time.

Weaknesses:

- Limited attention span: Children may have a shorter attention span and may not be as engaged in financial education as they would be with other types of content.

- Competition: There are several educational apps that compete for attention, and some of them may have a larger user base and more established brand recognition.

- User adoption: The app’s success will depend on its ability to attract and retain users.

Opportunities:

- Collaboration with financial institutions: The app can partner with financial institutions or banks to provide sponsorship or financial support, and to develop content that aligns with their products and services.

- Partnership with schools and educational institutions: The app can partner with schools and educational institutions to integrate financial education into their curriculum and reach a wider audience.

- International expansion: The app can expand to international markets where there is a growing demand for financial education.

Threats:

- Regulatory compliance: The app may need to comply with regulations and laws related to financial education, privacy, and data protection, which can increase costs and limit functionality.

- Economic downturns: Economic downturns or recessions can decrease demand for financial education and negatively impact the app’s revenue streams.

- Technological changes: Technological changes and advancements can make the app’s features or user interface obsolete, requiring significant updates and investment.

- Decreased demand for online-based education services and tools: As students and employees return back to school and workplaces as a result of reduced pandemic-related restrictions the demand for online education can reduce.

Marketing Strategies:

- Targeted Advertising: Reach parents and educators through social media ads, Google AdWords, or other forms of digital advertising.

- Influencer Marketing: Partner with influencers who have a strong following and are interested in promoting financial education for children to create content around the app and share it with their followers.

- Content Marketing: Create valuable and engaging content around financial education for children, such as blog posts, infographics, and videos. This content could be shared on social media, through email newsletters, or on the app itself.

- Public Relations: Reach out to media outlets and publications that cover education, parenting, and finance to generate coverage and interest in the app.

- Referral Marketing: Encourage users to refer their friends and family to the app by offering incentives such as discounts or rewards.

- Partnership Marketing: Partner with financial institutions, schools, and other organizations that are interested in promoting financial education for children. This could include co-branded marketing campaigns, sponsorships, or other collaborations.

- Community Outreach: Engage with local communities and organizations to raise awareness about the app and the importance of financial education for children. This could include speaking at events, hosting workshops, or collaborating with local schools and youth organizations.

Sales Channels

- Freemium model: Offer a basic free version, with limited features, and charge for premium features. For example, the free version could include a few basic lessons on saving and budgeting, while the premium version includes advanced lessons on investing, entrepreneurship, and financial planning.

- Subscription model: Charge a monthly or yearly subscription fee for access to the app’s content. This model works well if the app offers a wide range of features and lessons that are regularly updated and expanded.

- In-app purchases: Offer additional lessons, games, or activities that users can purchase within the app. For example, offer an interactive game that teaches kids about compound interest or stocks and bonds.

- Sponsorship and advertising: Partner with financial institutions, banks, or other companies to sponsor the app or advertise their products within the app. This model works well if the app has a large user base.

- B2B model: Offer the app as a tool for schools, after-school programs, or other organizations to use as part of their curriculum. This model would involve selling licenses to use the app to these organizations.

Lesson Five: Program Manage the Project.

While you may not want to hear it, to investors, great ideas are just that – ideas. A robust business case must include a clear action plan of how your fantastic idea will become a reality. Creating a compelling case for your project requires meticulous attention to several key aspects: project management plan, resource requirements, implementation planning, governance, and decision-making.

1. Project Management:

- Define Clear Objectives: Your project’s objectives must be crystal clear, specific, and aligned with your organization’s strategic goals. Ambiguity can be the enemy of success.

- Establish a Project Team: Identify and assign the right people to your project. Their skills, experience, and commitment will determine your project’s success.

- Project Plan: Develop a detailed project plan that outlines tasks, responsibilities, timelines, and milestones. This will be your roadmap.

2. Resource Requirements:

- Resource Identification: Clearly specify the human, financial, and technological resources required for your project. Don’t underestimate or overlook any essential resources.

- Cost Estimation: Calculate the costs associated with your project, including initial investments and ongoing operational expenses.

- Risk Assessment: Identify potential risks and uncertainties. Assess their potential impact and develop strategies for mitigation.

3. Implementation Plan:

- Detailed Execution: Your implementation plan should outline the step-by-step process for carrying out your project, from inception to completion.

- Dependencies: Identify any dependencies within the project, such as tasks that must be completed before others can begin.

- Monitoring and Control: Describe how you’ll monitor progress, measure performance, and make adjustments as needed.

4. Governance and Decision-Making:

- Decision-Making Structure: Clearly define your project’s decision-making structure. Who has authority? What’s the escalation process for issues or conflicts?

- Roles and Responsibilities: Outline the roles and responsibilities of all stakeholders involved in the project. This prevents confusion and duplication of efforts.

- Communication Plan: Develop a robust communication plan to ensure all stakeholders are informed and aligned throughout the project’s lifecycle.

In Conclusion

Like a great story, a strong business case takes the audience on an emotional journey and tells a tale of possibilities and transformation, culminating in a visionary broad strategy that helps the decision-makers understand the long-term impact of the investment. It’s about painting a bigger picture that resonates with stakeholders, customers, and employees. One crucial element that can elevate your business case from good to exceptional is ensuring it aligns with your organization’s broader strategy and higher vision.

Tesla’s business case, for example, extends beyond selling electric cars. It aligns perfectly with the vision of a sustainable future. Their electric vehicles are part of a larger mission to reduce carbon emissions and combat climate change. Similarly, Google’s commitment to organizing the world’s information and making it universally accessible and helpful is embedded in its business case. As such, every product or service they launch aligns with this vision. However, when there is a misalignment between the business case and the broader vision, the business needs to improve, as in the case of New Coke. Coca-Cola introduced the product in the 1980s to reformulate its flagship product, creating “New Coke.” While the business case may have looked good on paper, it did not align with consumers’ emotional connection with the brand. Coca-Cola eventually closed the project.

A strong closing statement aligns your company’s strategy with a higher vision to show lasting impact. By inspiring purpose and building trust, your business case can demonstrate the investment’s future potential.